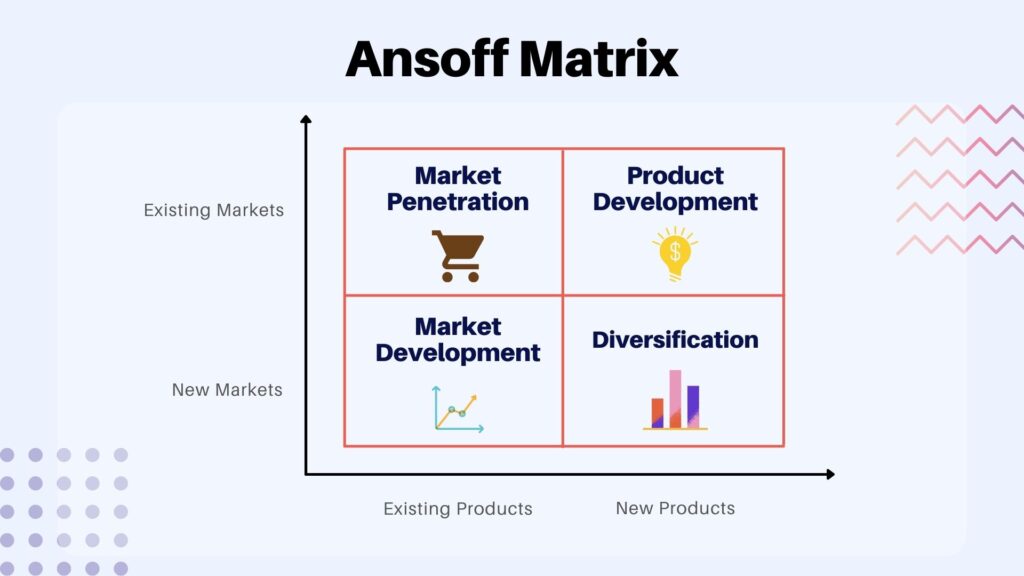

What is Product-Market Expansion Grid?

Product Market Expansion Grid, aka Ansoff Matrix, is a method to identify, evaluate, and select market opportunities and establish strategies for capturing them. It is a portfolio-planning tool identifying business growth opportunities with respect to the product and the market conditions. The method is based on the principle that companies should focus their resources to meet current market needs and the best opportunities. It was developed by the Russian-American economist/mathematician Igor Ansoff in the 1940s and has been widely used since then. The grid consists of four quadrants namely: Market penetration, Market development, Product development, and diversification. On the x-axis, we have existing products and new products and on the y-axis, we have existing markets and new markets.

The Ansoff Matrix: Market Penetration

The Market Penetration section identifies the markets a company currently serves and how to expand its presence in these existing markets. It is the process of making more sales to existing customers without changing its original products. It might add new stores in current market areas to make it easier to attract new customers.

The goal of the market penetration strategy is to penetrate a new or existing market by identifying and targeting a small group of customers who represent high growth potential. In this stage, businesses may develop more focused marketing strategies that are based on specific customer needs or desires. The introduction of current products to existing markets requires extensive market research on how best to reach these customers through different media channels such as direct mail, telemarketing, e-mail marketing, and online advertising. This strategy can be highly successful if it is executed correctly, but market penetration strategies are typically the most expensive, high risk, and time-consuming of all Ansoff Matrix strategies.

The Ansoff Matrix: Market Development

In the Market Development section of the matrix, companies identify market growth potential through product development, geographic expansion, strategic alliances with other companies and suppliers/clients. In this section of the matrix it is important for a company to determine which type of investment should be made: business unit investment (buying out existing operations), acquisition, or joint venture.

In the Market Development section, a company’s plan for growth is outlined. The goal of this market development strategy is to build a competitive advantage in an existing or new market by developing a unique product or service that will attract customers, gain market share, and help to differentiate itself from competitors. It involves providing better products and services at lower prices than its competitors’ offerings. In this stage, the business will also expand into other markets, either within or outside its current geographic boundaries.

The Ansoff Matrix: Product Development

The Product Development section of the matrix identifies new products and services that will meet customer needs and drive market growth. The product development strategy should involve working with customers, suppliers, and distributors to determine the specific features needed in a product.

The introduction of new products may involve creating an entirely new brand for a product range or integrating existing brands with other lines into one cohesive company image. This process will require extensive planning and coordination across many functions within the organization. Once this strategy has been implemented, companies must maintain it by continuing to develop unique offerings while simultaneously improving their processes and resources for delivery. This makes product development strategy require the highest amount of investment.

The Ansoff Matrix: Diversification

Diversification can be used as an investment option by companies to diversify their business away from a single product or service into multiple industries. Diversification strategies should always be undertaken with the Ansoff Matrix in mind to ensure that companies are developing products and services that will meet customer needs.

Companies must not only develop strategies for growing their business portfolio but also strategies for downsizing them considering the long term vision of the company. There are many reasons that a firm might want to abandon products or markets. May have grown too fast or entered areas where it lacks experience and the risk increases. The market environment change making some products for selling less profitable. Finally, some products or business units simply age and die. When a firm finds brands or businesses that are and profitable or that no longer fit the overall strategy it must carefully prune, harvest, or diverse them.

Types of diversification:

If a company’s strategy is to diversify into multiple markets, then it must evaluate and understand the current state of those markets and how these markets will affect its overall portfolio. There are three basic types of diversification: horizontal (also known as product or geographic), vertical (market), and value-added (segment).

Horizontal diversification:

It involves developing businesses within an industry with products designed for one another, such as automobiles designed for sale at retail stores which sell accessories such as windshield wipers.

Vertical diversification:

It involves developing businesses in different industries, for example, a chemical company that develops pesticides. Horizontal and vertical diversification are the most common forms of related diversification but they can be costly because they require specialized expertise.

Value-added diversification:

It is when a firm expands into new markets or industries by adding value to products or services of other companies. Value-added diversification is one of the most cost-effective forms of expansion and it involves adding value to other companies products or services. Value-added diversification can be highly profitable if a company makes decisions about which businesses to purchase based on knowledge gained from research, such as reading industry publications and talking with industry experts. However, it may not always be possible for a firm to know enough about an industry before making a decision because there is only so much information available in the public, making it an unrelated diversification to the core business. You can find some examples of failed diversification here.

Conclusion

We learned about the 4 quadrants of the product market expansion grid and how it can be used as a portfolio planning tool. As marketers/business leaders, this will help us to plan our business growth strategy and make good use of resources. Once you’ve created your plan, use it to analyze your own company and identify areas that need improvement. Let us know in the comments below if you would like to see any other examples of this concept.